When you see a sudden increase in new customers, it’s exciting. But do you wonder if these new customers are truly contributing significantly to your business’s revenue?

66% of consumers say they feel more valued when their feedback is acknowledged.

Understanding the value each customer brings is crucial for making informed decisions about whether to invest more in acquiring new customers or in retaining existing ones.

So, what makes a customer valuable? Is it the one who makes a one-time purchase of $2000, or the one who spends $100 regularly over several years?

A customer who makes small but consistent purchases over time is likely to generate more revenue than a customer who makes a single large purchase and never returns. This is why it’s essential for customer success and marketing teams to focus on retaining these high-value customers.

But how do you identify high-value customers? This is where the customer lifetime value (CLV) metric becomes essential. Learning how to calculate customer lifetime value helps businesses understand how well they resonate with their target audience, how satisfied customers are with their service, how to improve customer loyalty, and how to budget for customer retention campaigns.

In this blog post, we’ll explore how to calculate customer lifetime value and why it’s crucial to monitor this metric.

What is customer lifetime value?

Customer lifetime value (CLV) is a key business metric that measures the value of a customer i.e., how much money a customer is likely to spend on your products or services over time. Essentially, it represents the total revenue you can expect from a customer throughout their entire relationship with your business.

For example, if a customer subscribes to a helpdesk software on a one-year plan, their lifetime with your business is one year. The customer lifetime value in this case would be the revenue you anticipate earning from that customer during the year.

The longer a customer stays with your business and the more often they make purchases, the higher their CLV will be. This makes understanding and optimizing CLV crucial for maximizing long-term profitability.

Why is customer lifetime value important?

As mentioned earlier, customer lifetime value is an important metric for understanding the growth and value each customer brings over time. Customer lifetime value helps in boosting customer loyalty, reduces the customer churn rate, and helps in improving strategic decision-making. Let’s explore why CLV is important in more detail.

1. Increase in CLV increases revenue over time

The longer a customer stays with your business, the more value they bring, leading to increased revenue. Therefore, it is essential to track and improve the lifetime value of a customer. By tracking the value of customers, you can identify which customers contribute the most revenue and segment them based on their value. This segmentation allows you to tailor your marketing strategies to encourage these high-value customers to return.

2. Boost customer loyalty and retention

Analyzing CLV provides insights into customer behavior and preferences. This understanding enables businesses to make data-driven decisions and create personalized marketing strategies. Personalized marketing helps you stand out from the competition and fosters customer loyalty and retention.

Recommended Reading: 8 Easy Ways to Deliver Personalized Customer Service

3. Target your ideal customers

Tracking CLV helps you segment your customers based on their needs, preferences, and behaviors. Knowing the value of each customer gives you an idea of how much they are likely to spend over time. This information is valuable for developing customer acquisition strategies, personalizing marketing efforts, and allocating resources effectively to maximize value from your efforts.

4. Reduce customer acquisition cost

Retaining existing customers is more cost-effective than acquiring a new customer. CLV helps businesses focus on retaining customers by keeping them satisfied over the long term, thus improving their value to the business. Using CLV, you can enhance customer loyalty and benefit from word-of-mouth marketing while reducing sales and marketing expenses.

5. Improve your product or service

Understanding CLV also helps you gauge the value of your product or service. By analyzing customer feedback and behavior patterns, you can identify pain points and areas for improvement. This knowledge allows you to refine your approach to product development and better meet customer needs.

Recommended Reading: 100 Customer Satisfaction Survey Questions to ask in 2025

In summary, monitoring and improving customer lifetime value is essential for boosting revenue, enhancing customer loyalty, and making informed strategic decisions. By focusing on customer lifetime value, businesses can achieve long-term success and maximize profitability.

Boost retention & maximize CLV with Desk365

How is customer lifetime value different from other customer metrics?

Customer lifetime value metrics are different from other customer service metrics like the Net Promoter Score (NPS). While NPS measures customer loyalty, customer lifetime value measures the revenue generated from customer satisfaction. Customer lifetime value is directly tied to revenue, making it a tangible metric. In contrast, NPS is an intangible metric that reflects loyalty and satisfaction.

Understanding your customers’ CLV helps your business develop targeted strategies to attract new customers, retain existing ones, and maintain profit margins. Let’s explore how to calculate customer lifetime value.

Customer lifetime value models

When calculating customer lifetime value (CLV), it’s important to consider two key aspects: historical and predictive models. These models play a crucial role in measuring customer lifetime value, each offering different outcomes. Businesses can choose one based on whether they want to analyze past data or predict future customer behavior.

Predictive customer lifetime value model

The predictive model helps businesses forecast how new and existing customers are likely to make purchases. This is achieved using regression analysis or machine learning techniques. The predictive model allows businesses to identify their most valuable customers and determine which products or services drive the most sales. Additionally, it provides insights on how to improve customer retention.

Historical customer lifetime value model

The historical model uses past data to predict a customer’s value, without considering whether the customer will continue to do business with the company. This model is particularly useful when customers typically interact with the business over a specific period.

However, the historical model has some limitations. Customer journeys can vary greatly; an active customer might become inactive, and an inactive customer might start purchasing again, which can skew the data.

By understanding both models, businesses can choose the most appropriate approach for their needs, whether they want to analyze past performance or predict future trends.

How to calculate customer lifetime value?

Several factors come into play when measuring customer lifetime value (CLV). These include the average customer value, the average number of purchases made in a year, and the average retention time.

The customer lifetime value formula is:

Customer Lifetime Value = Customer Value × Average Customer Lifespan

Customer value

Customer value is the average amount of money a customer spends with your business over a specific period. It can be calculated as:

Customer Value = Average Value of Sales × Average Value of Transactions

To break this down further:

Average Value of Sales = Total Sales / Number of Days

Average Value of Transactions = Sales / Transactions

Average customer lifespan

The average customer lifespan is the average amount of time a customer continues to do business with you.

Average Customer Lifespan = Sum of Customer Lifespans / Number of Customers

Example calculation

Let’s understand this better with an example. Consider a business with subscription plans priced at $12, $24, and $36 per month, and an average sales value of $22. The company targets customers aged 30 to 50, who have been with the business for two years, spending an average of $24 per purchase.

Customer value calculation:

Customer Value = Average Value of Sales × Average Value of Transactions

= 22×24 = 528

Customer lifetime value calculation:

Customer Lifetime Value = Customer Value × Average Customer Lifespan

= 528×2 = 1056

Now, let’s consider another customer profile: aged between 18 to 25, with an average transaction value of $35 and an average customer lifespan of 1.2 years.

Customer value calculation:

Customer Value = Average Value of Sales × Average Value of Transactions

= 22 × 35 = 770

Customer lifetime value calculation:

Customer Lifetime Value = Customer Value × Average Customer Lifespan

= 770 × 1.2 = 924

This example shows that customers aged 30 to 50 have a higher CLV than those aged 18 to 25. Therefore, the SaaS company should focus on targeting middle-aged customers to maximize revenue.

Common mistakes around customer lifetime value

When businesses do not use customer lifetime value (CLV) wisely, they can fall into costly traps. To avoid these pitfalls, consider the following common mistakes:

1. Not segmenting your audience

While it might seem like a good idea to increase customer lifetime value across the entire customer base, this strategy can backfire. Marketing to everyone often means spending more on low customer lifetime value (CLV) customers. Instead, segment your audience to identify the most valuable customers and focus on increasing CLV among them.

2. Incorrectly segmenting your audience

Customer segments are groups of customers with similar characteristics. Make sure your customers are properly segmented, this helps businesses understand consumer behavior and what makes each group distinct. Incorrect segmentation can lead to wasted resources and ineffective marketing efforts.

3. Targeting low-value prospects

Some customers will inevitably abandon your product or service, while others will remain loyal. Investing in low-value customers is not worthwhile. Focus on finding ways to appeal to your target audience, but don’t expect every customer to have a high customer lifetime value.

4. Lacking flexibility

Economic conditions fluctuate, sometimes leading to recessions or inflation, which can impact customer lifetime value. Additionally, you may need to adjust your product or service prices based on market conditions. Ensure your business remains flexible during unpredictable situations to maintain and potentially increase CLV.

By avoiding these common mistakes, businesses can make better use of customer lifetime value to drive growth and profitability.

Tips to increase customer lifetime value (CLV)

Now that we understand what customer lifetime value (CLV) is and how to calculate it, let’s explore some strategies to increase it.

1. Optimize customer onboarding

Getting your customers up to speed quickly is crucial. Start the onboarding process within the first few days after their initial purchase. Personalize their experience using customer data. Here are some ways to do this:

- Offer recommendations based on their preferences and past purchases.

- Educate customers on how to use your product or service effectively by sharing how to videos.

- Keep in touch with your customers through email to guide them and providing useful information.

A knowledge base can simplify the onboarding process by making it easy for customers to find the information and support they need.

After onboarding, gather feedback through customer surveys. This feedback provides valuable insights into their experiences and helps you identify areas for improvement.

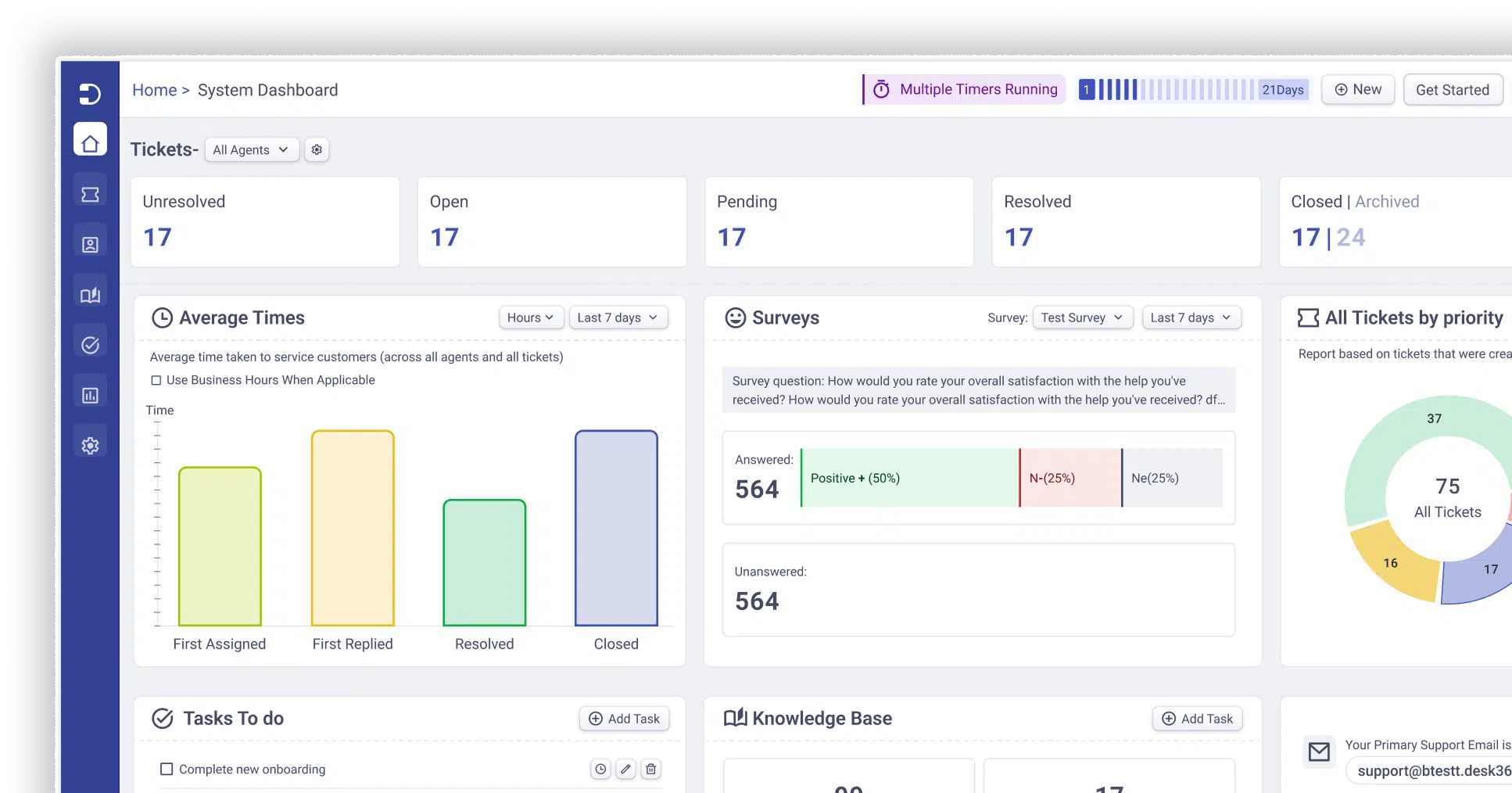

Analyze helpdesk metrics by using the data from your helpdesk and assess customer support performance. This information can highlight areas where you can enhance customer service, further improving the onboarding process and increasing customer lifetime value.

2. Listen to your customers

It’s essential to pay attention to what your customers are saying about your product or service. Understanding your audience and delivering good customer service are key components.

Unhappy customers frequently express their grievances on social media platforms. It’s important to monitor these platforms, understand their concerns, and show that you are working to resolve their issues.

Instead of viewing complaints as problems, see them as opportunities to improve your service. Addressing customer complaints effectively can turn a negative experience into a positive one, demonstrating your commitment to customer satisfaction.

By listening to your customers and actively responding to their feedback, you can build stronger relationships and improve your overall service, leading to increased customer loyalty and higher customer lifetime value.

3. Increase the average order value

One effective way to boost customer lifetime value is by increasing the average order value. Here are some strategies to achieve this:

- When a customer is about to complete a purchase, recommend related products that complement their chosen item. This technique, often known as cross-selling, can significantly increase the total value of the order.

- By offering complementary products, you not only increase the immediate order value but also improve the chances of customers returning for future purchases. This strategy encourages repeat business, contributing to a higher customer lifetime value (CLV).

4. Introduce a loyalty program

Loyalty programs are a great way to encourage repeat purchases and build an emotional connection with your customers. By offering rewards such as gifts and points, you can keep customers coming back, which improves both retention rates and spending over their lifetime. Benefits of loyalty programs include:

- Increased customer retention, customers are more likely to stay loyal when they receive rewards for their purchases.

- Loyal customers tend to spend more over time, boosting their overall lifetime value.

- Satisfied, loyal customers often spread the word about your brand, helping attract new customers.

Implementing a loyalty program can significantly enhance customer lifetime value by fostering customer loyalty and encouraging higher spending.

5. Reach out to your customers via omnichannel

It’s important to research and determine which communication channels your customers prefer, rather than making assumptions. Modern customers expect to interact with businesses across multiple platforms seamlessly. They don’t want to think twice about which channel to use—they want the freedom to choose the one that’s most convenient for them at any given moment.

By providing omnichannel support, you ensure that customers can reach you through their preferred methods, whether it’s email, social media, live chat, or phone. This approach helps create a more cohesive and satisfying customer experience. When customers feel they can easily communicate with your business, they are more likely to remain loyal and satisfied, which significantly reduces the customer churn rate.

6. Focus more on customer experience

When an issue isn’t resolved promptly, customer dissatisfaction can quickly rise. It’s crucial for businesses to invest in tools that allow customers to submit and track support tickets through a user-friendly interface. This is where choosing the best helpdesk ticketing system becomes essential.

Providing an outstanding customer experience not only satisfies your customers but also fosters brand loyalty. Customers are more likely to return if they feel your company offers the best service at a competitive price. By focusing on enhancing customer experience, you ensure that your customers remain happy and loyal, which is key to long-term success.

The benefit of customer lifetime value

Knowing how to calculate CLV helps you identify which customers spend the most and which ones remain loyal for longer periods.

Companies that understand the value of customer relationships can accurately forecast revenue growth and determine the most effective strategies for fund allocation.

Desk365 can assist you with data-driven strategies, real-time self-service options, omnichannel support, and a lot more to ensure customer satisfaction and build lasting customer relationships. Book a free demo or start your 21-day free trial to explore the features Desk365 has to offer.

Frequently asked questions

Customer Lifetime Value (CLV) is a metric that measures the total revenue a customer is expected to generate for your business during their relationship with you.

CLV can be calculated using the formula:

CLV = Customer Value × Average Customer Lifespan.

CLV helps businesses identify high-value customers, improve retention strategies, reduce acquisition costs, and make informed decisions for long-term profitability.

Desk365 offers tools like real-time self-service, omnichannel support, and data-driven insights to enhance customer satisfaction and retention, ultimately boosting CLV.